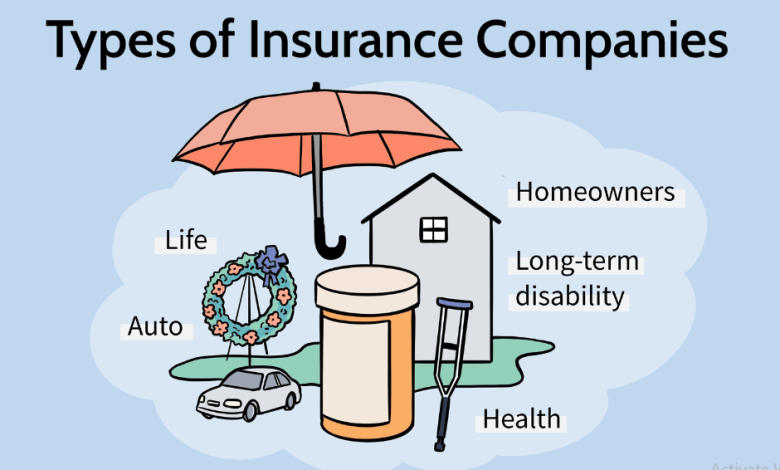

Understanding the Basics: Types of Insurance Coverage in the USA

Introduction:

In the complex landscape of insurance in the United States, understanding the various types of coverage available is crucial for individuals and businesses alike. This article aims to provide a comprehensive overview of the different types of insurance coverage commonly found in the USA, offering insights into their purposes, benefits, and considerations.

Health Insurance:

Health insurance is perhaps one of the most critical types of coverage for individuals and families. It helps mitigate the financial burden of medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care. In the USA, health insurance options include employer-sponsored plans, government programs like Medicare and Medicaid, and plans available through the Health Insurance Marketplace established by the Affordable Care Act (ACA).

Property Insurance:

Property insurance safeguards against damage or loss to physical assets such as homes, rental properties, and personal belongings. This type of coverage typically includes homeowners insurance, renters insurance, and condominium insurance. It provides protection against perils such as fire, theft, vandalism, and natural disasters like hurricanes and earthquakes. Property insurance policies can also include liability coverage, which offers financial protection in the event of lawsuits related to property damage or bodily injury.

Auto Insurance:

Auto insurance is mandatory in most states in the USA and provides financial protection in case of accidents involving vehicles. Policies typically include coverage for bodily injury liability, property damage liability, medical payments, and uninsured/underinsured motorist coverage. Optional coverages like collision and comprehensive insurance can also be added to provide additional protection for your vehicle against damage from collisions, theft, vandalism, and other non-collision incidents.

Life Insurance:

Life insurance offers financial protection to beneficiaries in the event of the policyholder’s death. It can help cover expenses such as funeral costs, outstanding debts, mortgage payments, and provide income replacement for dependents. Common types of life insurance in the USA include term life insurance, which provides coverage for a specified period, and permanent life insurance, such as whole life and universal life, which offer coverage for the policyholder’s entire life with an investment component.

Business Insurance:

Business insurance protects companies from financial losses resulting from unforeseen events or lawsuits. It encompasses various types of coverage, including general liability insurance, property insurance, professional liability (errors and omissions) insurance, workers’ compensation insurance, and business interruption insurance. These policies help mitigate risks associated with property damage, legal claims, employee injuries, and disruptions to business operations.

Conclusion:

Navigating the diverse landscape of insurance coverage in the USA can be daunting, but understanding the basics of each type of insurance is essential for making informed decisions to protect yourself, your loved ones, and your assets. By assessing your needs and evaluating available options, you can select the right mix of coverage to safeguard against potential risks and uncertainties in life and business.