An Extensive Handbook on Life Insurance Choices in the United States

Introduction:

Navigating the world of life insurance can often feel like traversing a labyrinth, with a multitude of options and complex terminology to decipher. In the United States, where the insurance industry is vast and diverse, understanding the nuances of life insurance choices is essential for individuals and families seeking to safeguard their financial future. This extensive handbook aims to serve as a comprehensive roadmap, illuminating the array of life insurance options available in the United States and empowering readers to make informed decisions that align with their unique needs and goals.

Body:

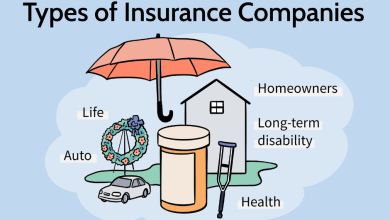

- Types of Life Insurance: The handbook begins by elucidating the different types of life insurance available in the United States, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type offers distinct features, benefits, and drawbacks, catering to varying preferences and circumstances.

- Coverage and Benefits: Delving deeper, the handbook explores the coverage and benefits provided by each type of life insurance. From death benefits that provide financial security to beneficiaries, to cash value accumulation that offers a source of savings and investment, understanding the scope of coverage and potential advantages is paramount.

- Factors Influencing Choice: Recognizing that the decision-making process is multifaceted, the handbook examines the factors that influence the choice of life insurance. Age, health status, financial objectives, risk tolerance, and budgetary constraints are among the key considerations that readers are encouraged to evaluate thoughtfully.

- Policy Customization and Riders: Beyond the basic structure of life insurance policies, the handbook elucidates the options for customization and the availability of riders. From adjusting coverage amounts to adding supplementary benefits such as accelerated death benefits or long-term care riders, tailoring policies to suit individual needs enhances their effectiveness and relevance.

- Policy Management and Review: As life circumstances evolve, so too may insurance needs. The handbook emphasizes the importance of periodic policy review and management, highlighting strategies for reassessment, adjustment, and optimization to ensure that life insurance coverage remains aligned with changing circumstances and objectives.

Conclusion:

In the tapestry of financial planning, life insurance serves as a cornerstone, providing stability, security, and peace of mind for individuals and families alike. This extensive handbook on life insurance choices in the United States endeavors to demystify the complexities of the insurance landscape, equipping readers with the knowledge and insights needed to navigate with confidence. By understanding the array of options available, assessing personal needs and priorities, and engaging in thoughtful decision-making, individuals can harness the power of life insurance to protect their loved ones and fortify their financial future. As a trusted companion on the journey toward financial resilience, this handbook stands as a beacon of guidance, illuminating the path to informed choices and enduring security.